Financial Management Tips for Creative Businesses

Running a creative business comes with its own set of challenges, especially when it comes to managing finances. Creativity and financial acumen may seem like polar opposites, but finding a balance between the two is crucial for the success of your venture. In this article, we will explore some essential financial management tips tailored for creative businesses to help you navigate the often complex world of money management.

Understanding Your Cash Flow

Cash flow is the lifeblood of any business, and for creative ventures, it is particularly important to have a clear understanding of how money moves in and out of your company. As a creative business owner, you may experience fluctuations in income due to the seasonality of projects or the unpredictable nature of the industry. Keeping a close eye on your cash flow will help you anticipate any potential gaps in funding and make informed decisions to mitigate cash flow challenges.

Separating Personal and Business Finances

One common pitfall for creative entrepreneurs is mixing personal and business finances. To ensure financial clarity and prevent any potential tax or legal issues, it is essential to keep your personal and business finances separate. Open a dedicated business bank account and use it exclusively for all business-related transactions. This separation will not only simplify your accounting process but also provide a clear picture of your business’s financial health.

Budgeting Wisely

Budgeting is a fundamental aspect of financial management for creative businesses. While the unpredictable nature of the industry may make it challenging to create a rigid budget, having a general outline of your expenses and revenue projections is crucial. Be realistic in your budgeting approach and allocate funds wisely to cover essential costs such as materials, marketing, and overhead expenses. Regularly review and adjust your budget to reflect any changes in your business operations.

Negotiating Fair Rates

Creative professionals often struggle with setting fair rates for their services. It is essential to value your work appropriately and negotiate fair rates that reflect the quality and expertise you bring to the table. Research industry standards and competitor pricing to ensure that you are pricing your services competitively while also accounting for the value you provide to clients. Don’t undersell your talents; remember that your creativity has intrinsic value that deserves fair compensation.

Diversifying Revenue Streams

In the creative industry, income can be unpredictable, with projects coming and going sporadically. To mitigate the risks associated with fluctuating income, consider diversifying your revenue streams. Explore opportunities to offer additional services, such as workshops, online courses, or merchandise, to supplement your primary source of income. Diversification can help stabilize your cash flow and provide a buffer during lean periods.

Investing in Professional Development

Continuous learning and skill enhancement are essential for staying competitive in the creative industry. Investing in professional development not only enhances your expertise but also expands your marketability and earning potential. Allocate a portion of your budget to attend workshops, conferences, or online courses that can help you refine your skills and stay abreast of industry trends. By investing in yourself, you are investing in the future success of your creative business.

Monitoring Key Performance Indicators

Tracking key performance indicators (KPIs) is vital for assessing the financial health and overall performance of your creative business. Identify relevant KPIs such as client acquisition cost, project profitability, or revenue per client to measure the effectiveness of your business operations. Regularly monitor these metrics and use them to inform strategic decisions and identify areas for improvement. By staying informed about your business’s performance, you can make data-driven decisions that drive growth and profitability.

Embracing Technology for Financial Management

In today’s digital age, leveraging technology for financial management can streamline your operations and enhance efficiency. Explore accounting software, budgeting tools, or invoicing platforms that can automate repetitive tasks and provide valuable insights into your financial performance. Embracing technology can help you save time, reduce errors, and gain a better understanding of your business’s financial standing.

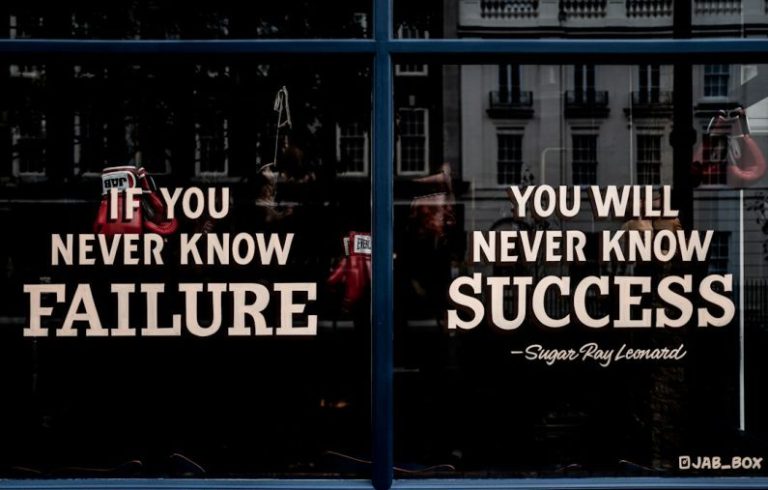

Adopting a Growth Mindset

Financial management for creative businesses is not just about balancing the books; it is also about fostering a growth mindset that empowers you to take calculated risks and pursue opportunities for expansion. Embrace challenges as learning opportunities, and be willing to adapt your strategies based on feedback and market trends. By maintaining a growth mindset, you can position your creative business for long-term success and sustainability.

Incorporating these financial management tips into your creative business can help you navigate the complexities of money management and set a solid foundation for growth and profitability. Remember, financial acumen is a valuable skill that complements your creative talents and plays a crucial role in the success of your venture. By being proactive, strategic, and mindful of your finances, you can build a financially resilient creative business that thrives in a competitive market.